Nj Tax Brackets 2024 Chart – For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, . Curious about what tax bracket you’re in? To figure it out, you’ll need a few numbers: 1) your taxable income and 2) a chart listing this year’s tax rates. .

Nj Tax Brackets 2024 Chart

Source : www.whitecoatinvestor.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

2023 State Corporate Income Tax Rates & Brackets | Tax Foundation

Source : taxfoundation.org

How Tax Brackets Work [2024 Tax Brackets] | White Coat Investor

Source : www.whitecoatinvestor.com

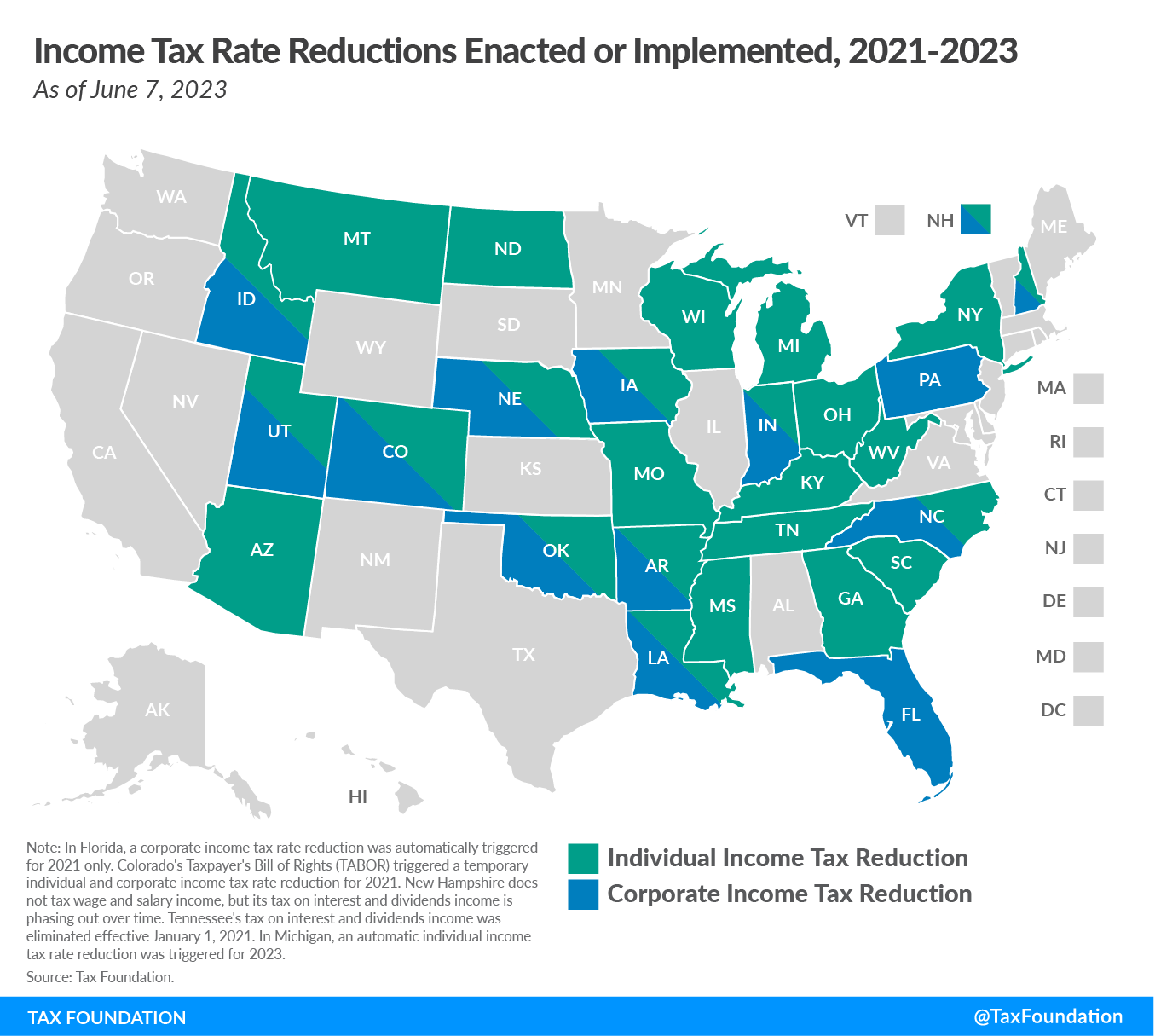

State Tax Reform and Relief Trend Continues in 2023

Source : taxfoundation.org

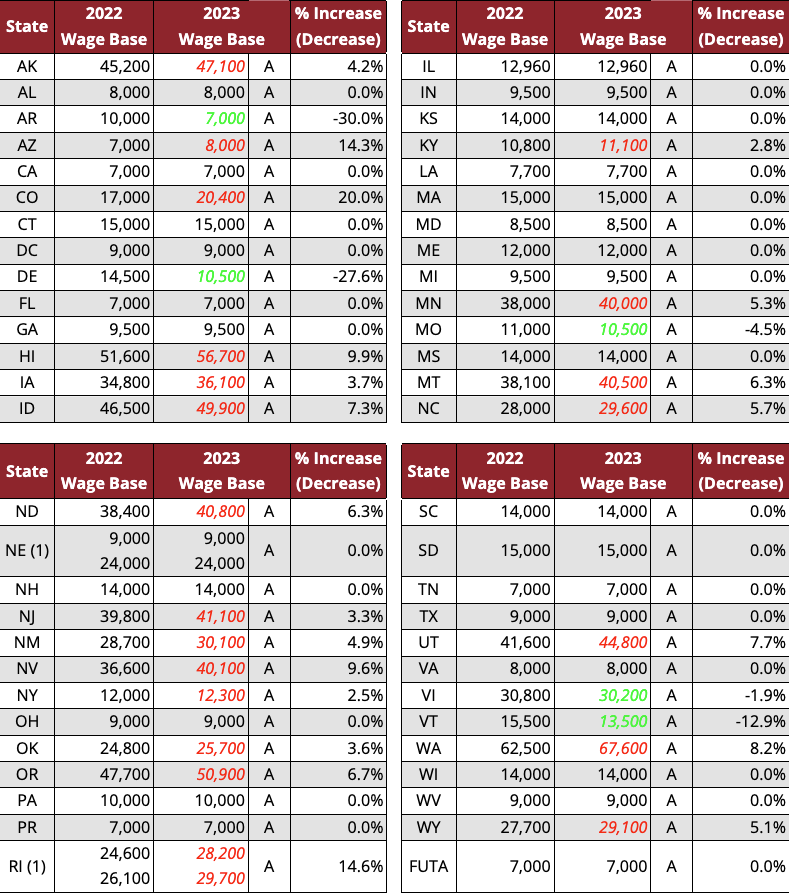

Outlook for SUI Tax Rates in 2023 and Beyond

Source : workforce.equifax.com

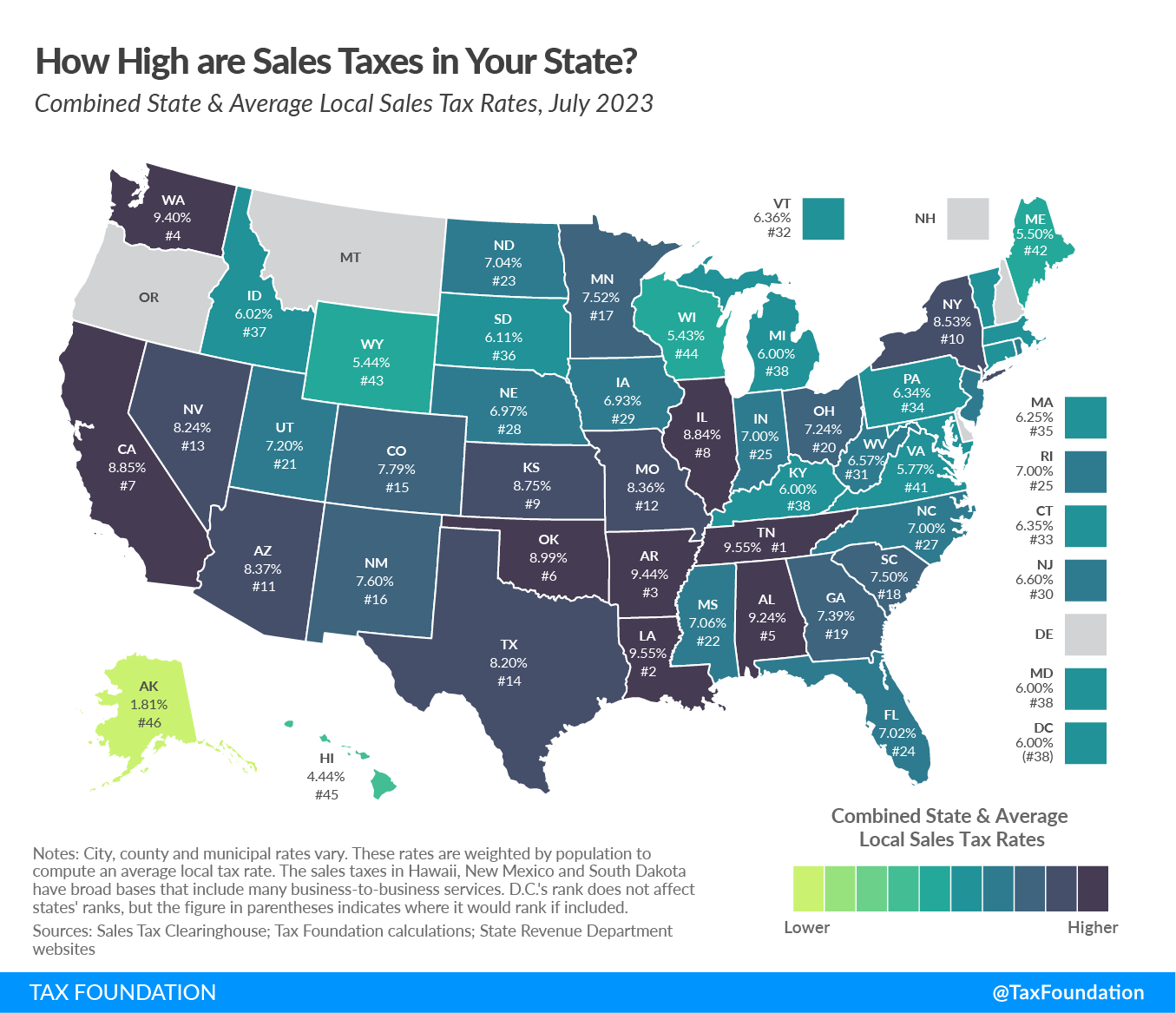

State and Local Sales Tax Rates, Midyear 2023

Source : taxfoundation.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

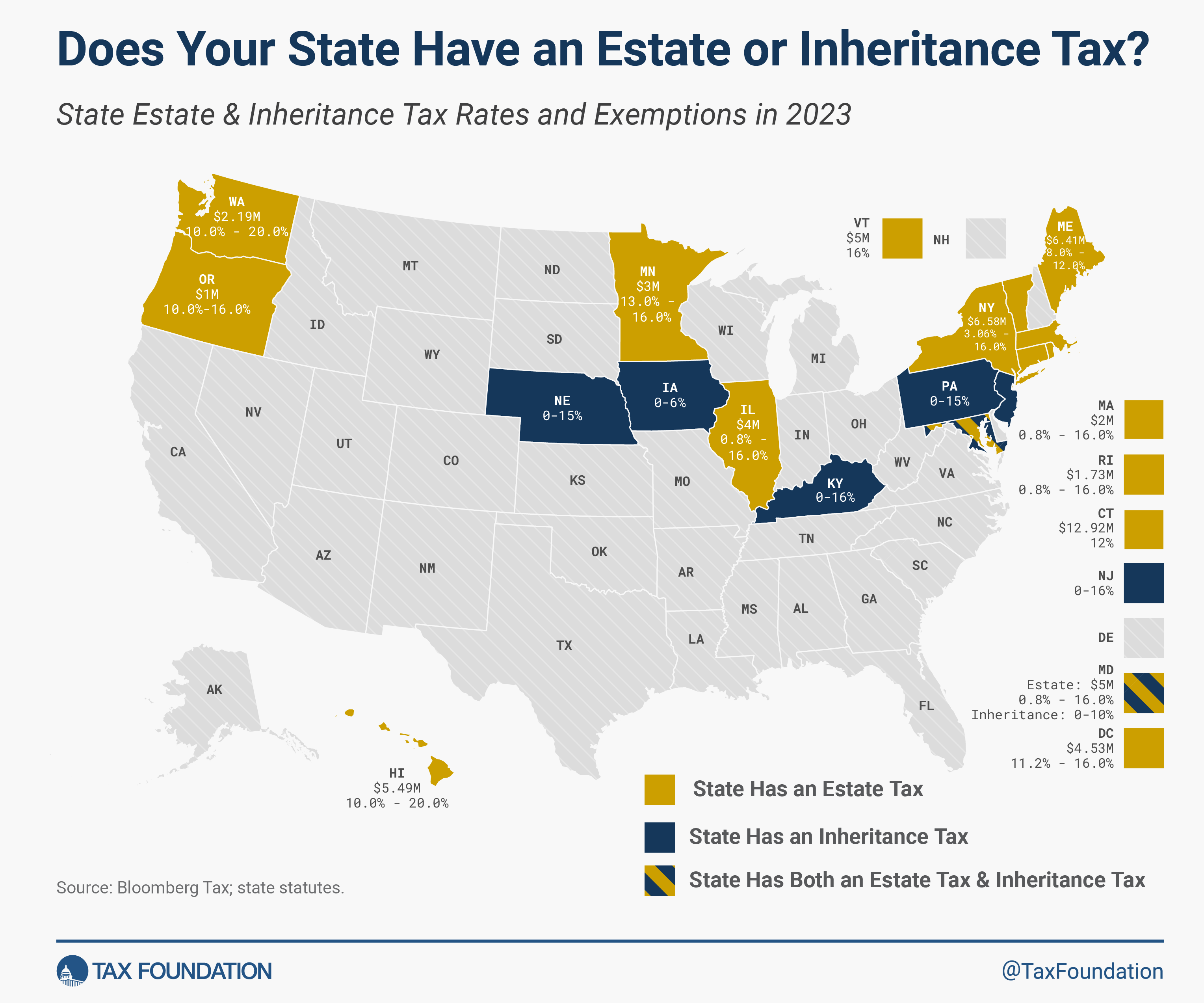

2023 State Estate Taxes and State Inheritance Taxes

Source : taxfoundation.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Nj Tax Brackets 2024 Chart How Tax Brackets Work [2024 Tax Brackets] | White Coat Investor: How do tax brackets work? A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective . According to Fox Business, tax brackets have shifted higher by 5.4% in 2024 for both single and joint filers. Standard decisions also took effect at the beginning of January which will .