New Child Tax Credit 2016 – With a new child, your taxes will get more complicated. But the flip side is you may qualify for a slew of new tax credits and deductions. The first order of business is to make sure your child . The Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children so what are the new requirements for claimants in .

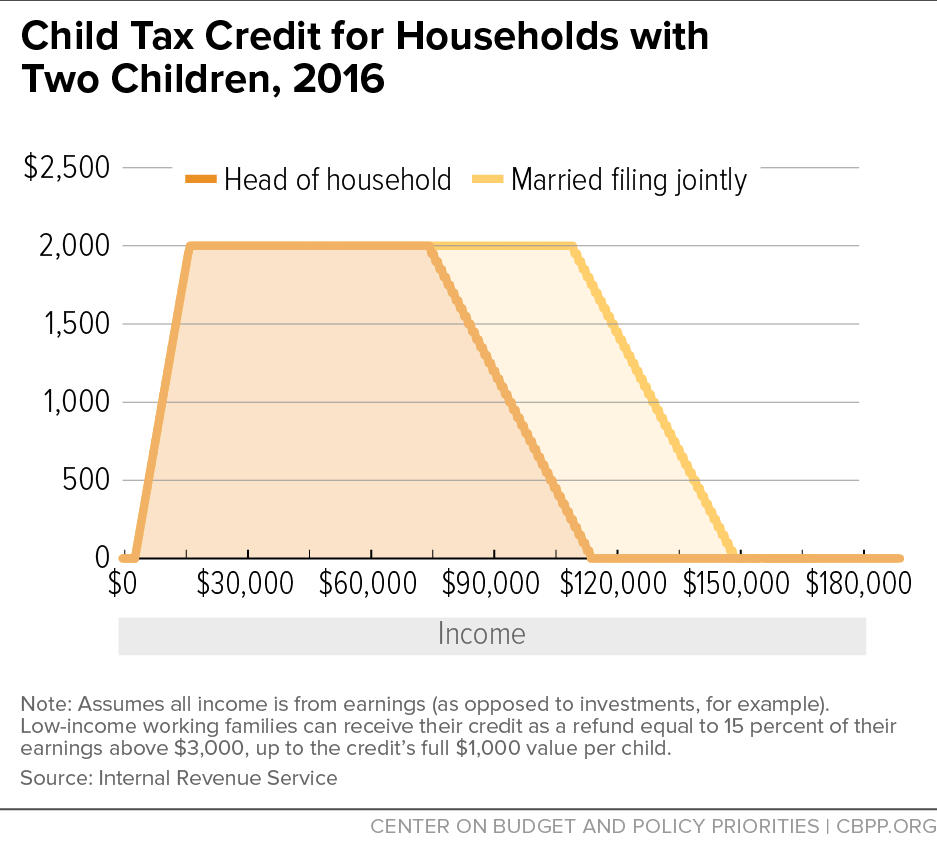

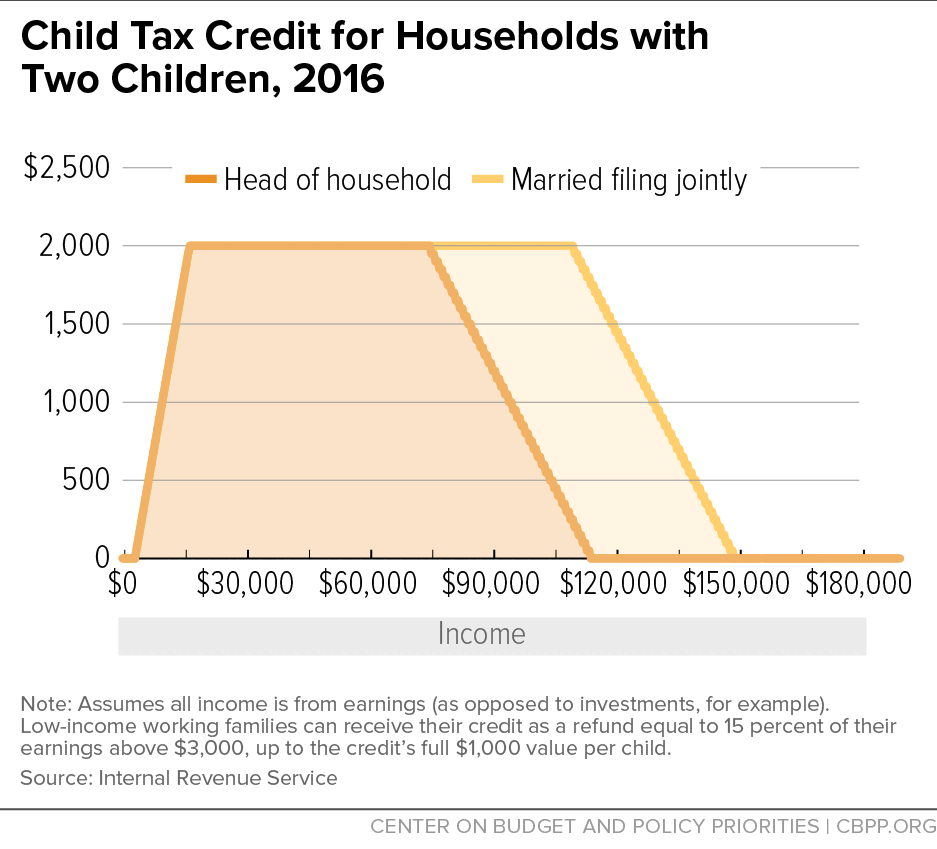

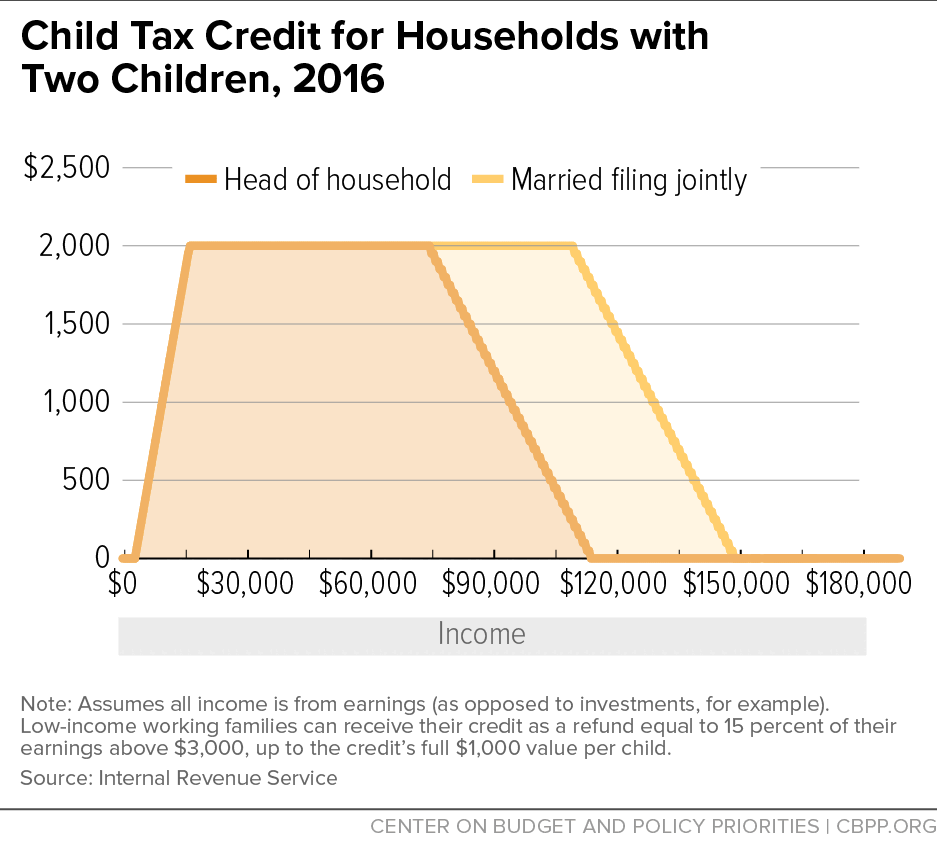

New Child Tax Credit 2016

Source : www.cbpp.org

T16 0249 Benefits of the Child Tax Credit, by Expanded Cash

Source : www.taxpolicycenter.org

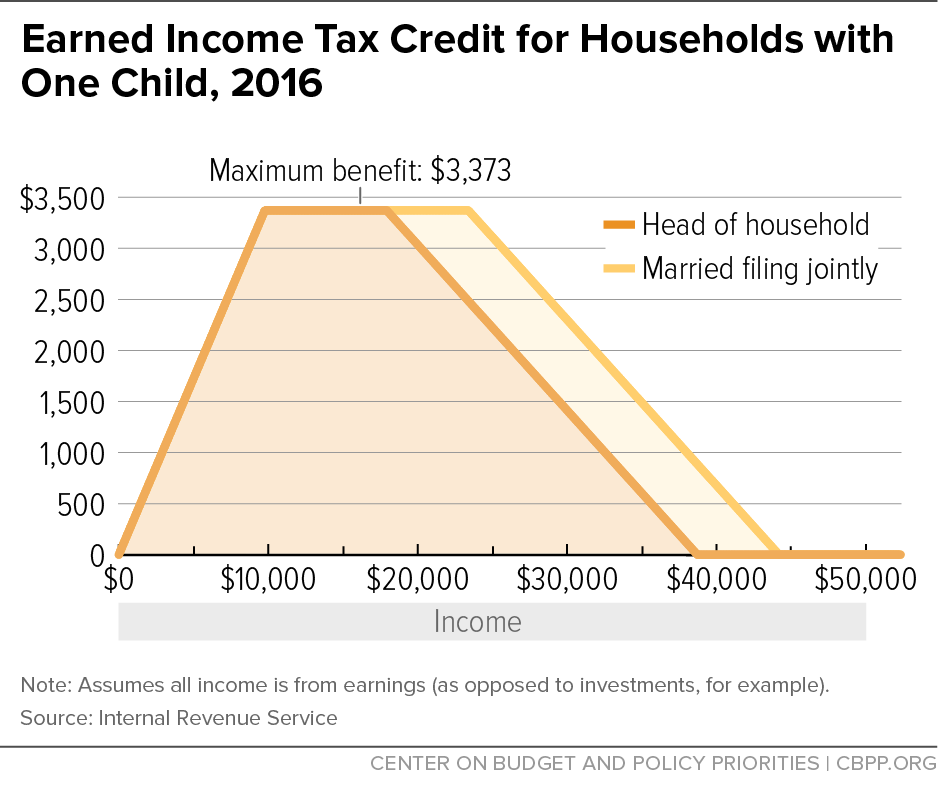

Earned Income Tax Credit for Households with One Child, 2016

Source : www.cbpp.org

New Markets Tax Credits | OCC

Source : www.occ.gov

Chart Book: The Earned Income Tax Credit and Child Tax Credit

Source : www.cbpp.org

2016 Instruction 1040 Schedule 8812

Source : www.irs.gov

A Top Priority to Address Poverty: Strengthening the Child Tax

Source : www.cbpp.org

Enterprise Community Partners

Source : www.hud.gov

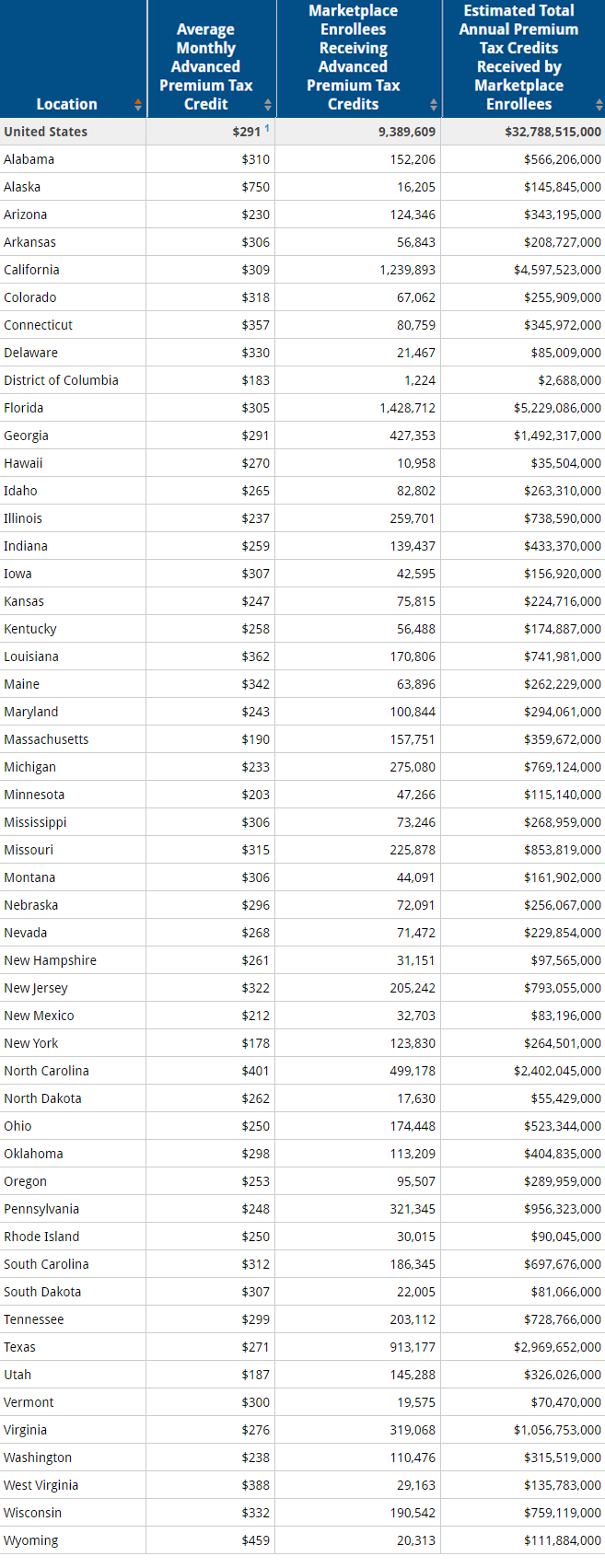

New State Data: ACA Marketplace Enrollees Receiving Estimated

Source : www.kff.org

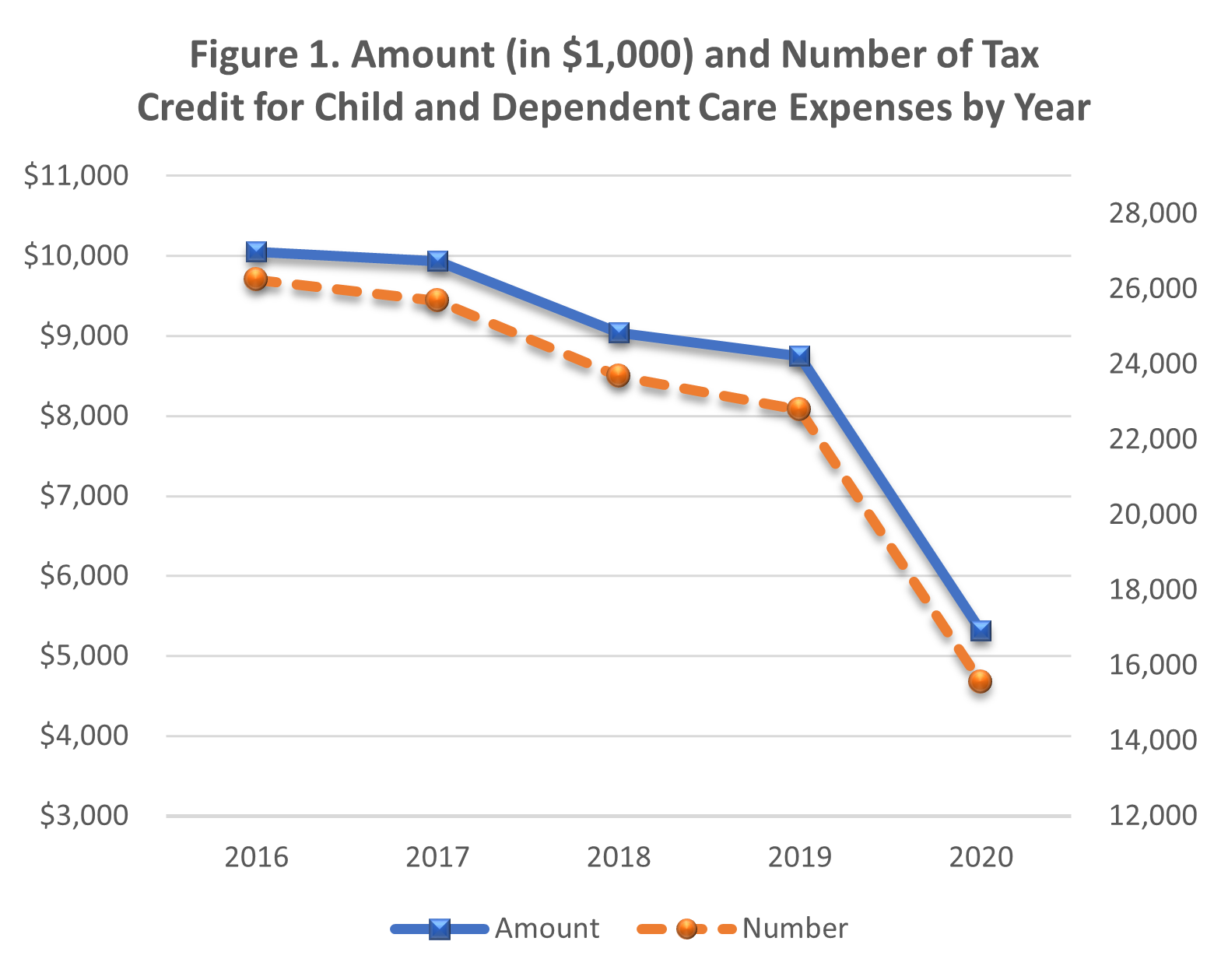

Covid 19 reduced the usage of the Child Care Tax Credit

Source : tax.hawaii.gov

New Child Tax Credit 2016 Child Tax Credit for Households with Two Children, 2016 | Center : Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child Tax Credit offers support their children so what are the new requirements for claimants in 2024 . “I haven’t heard anything about them doing another advance tax credit, but we are heading into a recession,” Finocchiaro says. Taxpayers must meet income requirements to claim the child tax .